The Roller Coaster of Trader's Emotions: 12 Steps That Will Improve Your Investing Decisions

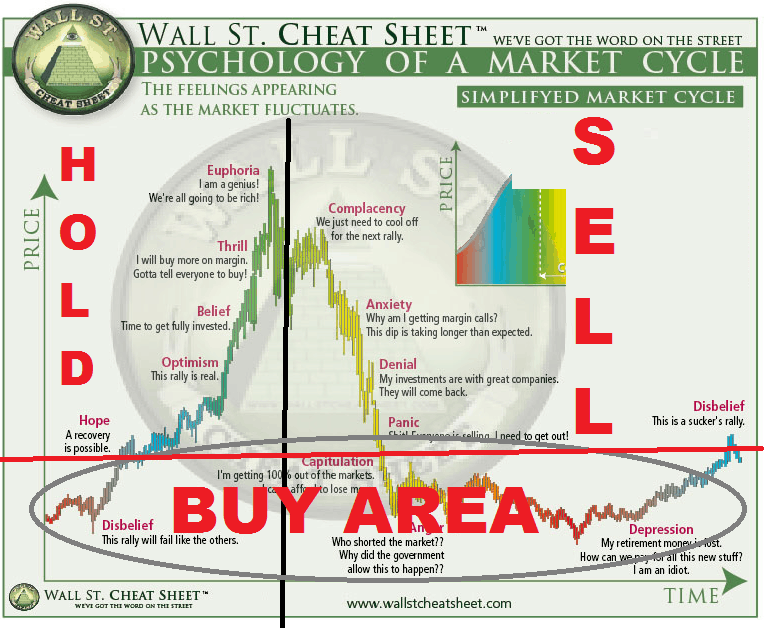

Learning how market cycles operate can be extremely beneficial to your trading, understanding the true influence of fear and greed.

But... Controlling your emotions within the market is your main 'personal' objective, becoming an emotionless trader. It's what we're all told from day one right?

90% of trading is purely psychology. It is the main reason why so many traders fail as they let their trading become over-ruled by their emotions, thus making irrational decisions.

Many traders will never overcome their inherent emotional biases, therefore you should seek to understand the range of emotions we may experience as investors and how it affects our interactions within the market.

The psychology of trading defines a specified range of emotions that an investor can go through while making an investment decision. Explained below are the 12 stages of investor emotions:

1. Optimism

Almost every investing emotional cycle begins with an intense feeling of excitement. You’re expecting things to go your way or at the very least, to see decent returns for taking on the risk of investing.

2. Belief

This optimism escalates into belief as you witness the market rises even more so and other buyers start to make a profit. You can’t be any more confident.

3. Thrill

As your investments begin to prove successful, you feel thrilled. You had never imagined you would be making such good profits. This emotion makes you feel proud of yourself, and take the first step towards overconfidence.

4. Euphoria

“You can’t miss opportunities”. Market grows, investments turn into quick and easy profits. Everyone wants to jump in: Who doesn’t want to make a ton of money risking as little as possible? The market is rising, isn’t it? At this point, the financial risk is at it maximum, like the possible financial gain.

5. Anxiety

Things start to turn around, markets show the first signs of weakness but overall the sentiment for the long term is still bullish and you convince yourself that it is just a short correction.

6. Denial

When markets have not rebounded, yet we do not know how to respond, we begin denying that we made poor choices. Our "long-term" view now shortens to a near-term hope of an improvement.

7. Panic

At some point you have to compare your perception with the reality, maybe you haven’t been that smart. You would like to get out taking a small profit or even a small loss but you don’t act because you don’t know what to do, uncertainty is at its maximum.

8. Capitulation

You cannot believe that this is happening to you and you start to become desperate to seek any ideas from anyone and everyone. You look for ways to become profitable again so that you don't lose your money in the market.

9. Anger

This is the period with the most emotional impact, where you feel helpless and really don’t know what to do, feeling without any degree of control on the situation, on your investments and on markets.

10. Depression

This is the beginning of the aftermaths of the crash. You start thinking about what happened and ask yourself how you could have been that stupid. The key that makes the difference among investors here is if you start to look back to what happened and analyze what went wrong and start learning from from past mistakes.

11. Disbelief

Your expectations have been disappointed, you got a strong loss from your investments, you feel bad and you don’t want to buy a crypto / stock ever again. This is the point of maximum financial opportunity for investors that are aware of what is going on and are willing to be contrarians.

12. Hope

As the market returns to its former glory, you revert to the market in the hope of making profits once again. This is the emotion that makes the investor more careful and eventually leads to profits.

EngineeringRobo that allows you to potentially identify and take advantage of trends while being in full control of your trades.

It can take years how to properly read charts & understand the different pairs to be able to successfully & consistently pick the right trades, and even then, with all the experience in the world, traders still have to spend hours & hours sitting in front of computer screens analysing the markets & news while trying to control human emotions in order to be successful.

It’s not easy at all and can be extremely stressful & time consuming!

It’s actually the human emotions that are responsible for a lot of mistakes that traders make, they could have had an argument with their partner, could be stressed over bills or even something as small as a bad nights sleep can have an affect on how they trade.

You see, computers have no emotions and the software identifies patterns in the market based off of historical data. But It’s eliminating the bad trades made out of emotions such as fear, greed and excitement that is the real game changer here!.